数字经济研究院

凯发网站以自主创新科技服务实体经济,助力国家数字经济发展

科研成果和应用转化案例

联合中科院等顶尖科研机构和团队,打造优质科研成果转化平台

关于凯发网站

凯发网站以自主创新科技服务实体经济,助力国家数字经济发展

凯发网站是一家外商独资企业、公司创始人是澳大利亚中国和平统一促进会常务副会长、著名爱国侨领LEO YANG,隶属澳大利亚金银交易所和澳金创投基金。

2020年。受中央统战部、海南省省委、四川省省委及广东省经贸委等有关部门邀请。对中国政府推动的数字经济转型及其带来的广阔前景深感振奋,为促进中国与国际间的高新科技和文化交流贡献力量,澳大利亚金银交易所和澳金创投基金参与了中国国内多次商业考察和交流,决定成立凯发网站。

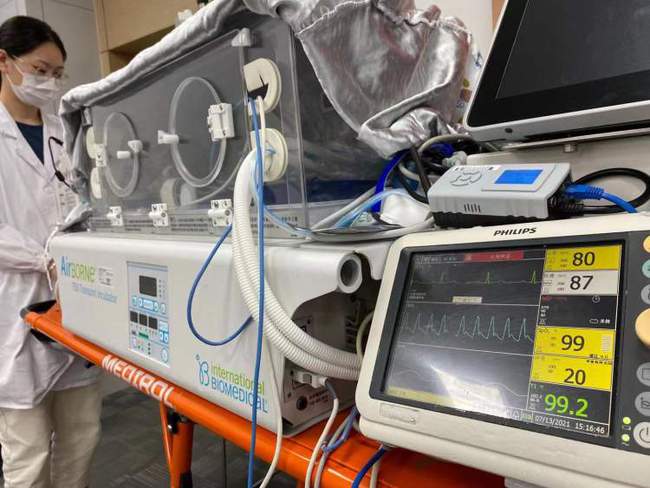

凯发网站以创新科技服务实体经济、致力于成为具有行业影响力的专业数字生态高科技企业。公司联合中科院软件技术应用研发部门、力争成为国家大数据战略的推动者和新基建领域排头兵,服务中国实体经济,积极参与数字经济转型和行业链改。

我们倡导自由、开放、创新、共赢的合作理念、用心为客户提供优质服务,创造价值。

凯发网站以自主创新科技服务实体经济

助力国家数字经济发展

Serving the real economy with independent innovation and technologyWe will help develop the national digital economy

Copyright©2020 凯发网站 版权所有 粤ICP备2021081636号